Reports & key financials

Tallink Grupp releases its financial results four times a year, after the end of each financial quarter.

Tallink Grupp

TAL1T | ISIN EE3100004466

0.0000 €

NaN (0% ↑)

Open

0

High

0

Low

0

Volume

0

Information as of: January 01, 1970 at 00:00 AM (GMT +3)Nasdaq Tallinn

Reports

Q2

23.07.2026

Interim Report Q2

IITraffic volume

IIAugust 2026

Factsheet

23.07.2026

Webinar

IQ3

22.10.2026

Interim Report Q3

IITraffic volume

IIOctober 2026

Factsheet

22.10.2026

Webinar

IQ4

19.02.2027

Interim Report Q4

ITraffic volume

IIFebruary 2027

Factsheet

19.02.2027

Webinar

IQ1

Q2

Q3

Q1

Q2

Q3

Q1

Q2

Q3

Q1

Q2

Q3

| Event | Date |

|---|---|

| December traffic volumes | 5 January 2026 |

| January traffic volumes | 3 February 2026 |

| Unaudited 12-months interim report | 19 February 2026 |

| February traffic volumes | 3 March 2026 |

| March traffic volumes | 6 April 2026 |

| Unaudited 3-months interim report | 23 April 2026 |

| April traffic volumes | 5 May 2026 |

| May traffic volumes | 3 June 2026 |

| June traffic volumes | 3 July 2026 |

| Unaudited 6-months interim report | 23 July 2026 |

| July traffic volumes | 4 August 2026 |

| August traffic volumes | 3 September 2026 |

| September traffic volumes | 5 October 2026 |

| Unaudited 9-months interim report | 22 October 2026 |

| October traffic volumes | 3 November 2026 |

| November traffic volumes | 3 December 2026 |

Traffic volume

Financial results

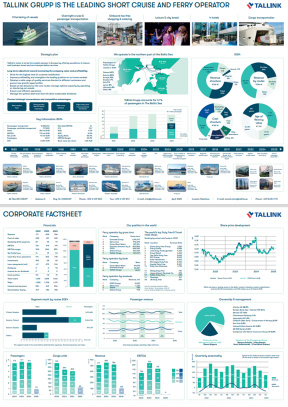

| million, EUR | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|

| Net sales | 443 | 477 | 771 | 835 | 786 | 765 |

| Gross profit/loss | -43 | 22 | 114 | 204 | 154 | 143 |

| EBITDA | 8 | 58 | 136 | 215 | 175 | 130 |

| Net profit/loss | -108 | -57 | 14 | 79 | 40 | 17 |

| Depreciation | 101 | 95 | 98 | 101 | 98 | 80 |

| Investments | 100 | 20 | 203 | 28 | 22 | 33 |

| Total assets | 1,516 | 1,586 | 1,692 | 1,555 | 1,464 | 1,330 |

| Total liabilities | 802 | 893 | 985 | 770 | 682 | 581 |

| Interest-bearing liabilities | 705 | 780 | 854 | 649 | 556 | 446 |

| Net debt | 677 | 652 | 739 | 607 | 538 | 432 |

| Total equity | 714 | 693 | 707 | 786 | 782 | 750 |

| Fleet value | 1,135 | 1,083 | 1,288 | 1,238 | 1,175 | 1,067 |

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Gross margin | -9.8% | 4.5% | 14.7% | 24.4% | 19.5% |

| EBITDA margin | 1.8% | 12.2% | 17.6% | 25.7% | 22.3% |

| Net margin | -24.5% | -11.9% | 1.8% | 9.4% | 5.1% |

| Return on assets (ROA) | -6.1% | -2.4% | 2.4% | 7.0% | 5.1% |

| Return on equity (ROE) | -14.1% | -8.2% | 2.1% | 10.6% | 5.2% |

| Return on capital employed (ROCE) | -2.8% | 3.1% | 8.4% | 5.7% | 6.0% |

| Equity ratio | 47% | 44% | 42% | 50.5% | 53.4% |

| Net debt / EBITDA | 84.2 | 11.2 | 5.4 | 2.8 | 3.1 |

| Number of employees as at the end of year | 4,200 | 4,785 | 4,904 | 4,912 | 4,849 |

Latest publications of AS Tallink Grupp

Frequently asked questions

- What is Tallink Grupp's financial year?What is Tallink Grupp's financial year?

Tallink Grupp’s financial year runs from 1 January to 31 December. However, prior to 2011 Tallink Grupp’s financial year started on 1 September and ended on 31 August.

- Where can I listen to Tallink Grupp’s results’ webinars?Where can I listen to Tallink Grupp’s results’ webinars?

Tallink Grupp holds quarterly webinars, which typically take place on the same day with the disclosure of quarterly results. Invitation to webinars is circulated about a week before the webinar through a stock exchange announcement. Subscription for Tallink Grupp’s stock exchange announcements can be registered.

- Who is Tallink Grupp’s independent auditor?Who is Tallink Grupp’s independent auditor?

Tallink Grupp’s independent auditor is KPMG Baltics OÜ. Please refer to Tallink Grupp’s most recent annual report for the latest independent auditor’s report.

Company Factsheet

Company Factsheet  Company Q3 Presentation

Company Q3 Presentation